social security tax rate 2021

Employees are taxed at 62 of wages earned so if someone earned the maximum taxable wages of 128400 they. Ad See If You Qualify To File For Free With TurboTax Free Edition.

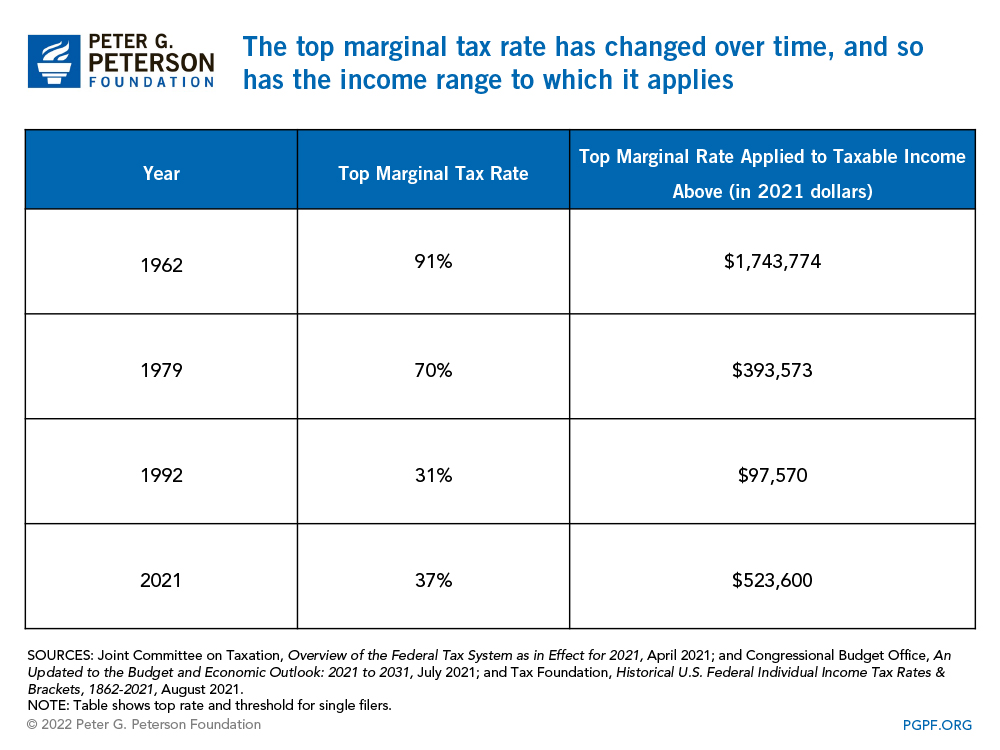

How Do Marginal Income Tax Rates Work And What If We Increased Them

Additional Medicare Tax Withholding Rate.

. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. However you will. We call this annual limit the contribution and benefit base.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. Each January you will receive a Social Security Benefit Statement Form SSA-1099. A rise in Medicare Part B premiums in 2023 would offset a portion of the COLA increase for Social Security recipients who have Medicare premiums deducted directly from.

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding 50000 single filers or 100000 married filing jointly. When you have more than one job in a year each of your employers must withhold Social Security taxes from your wages. The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax.

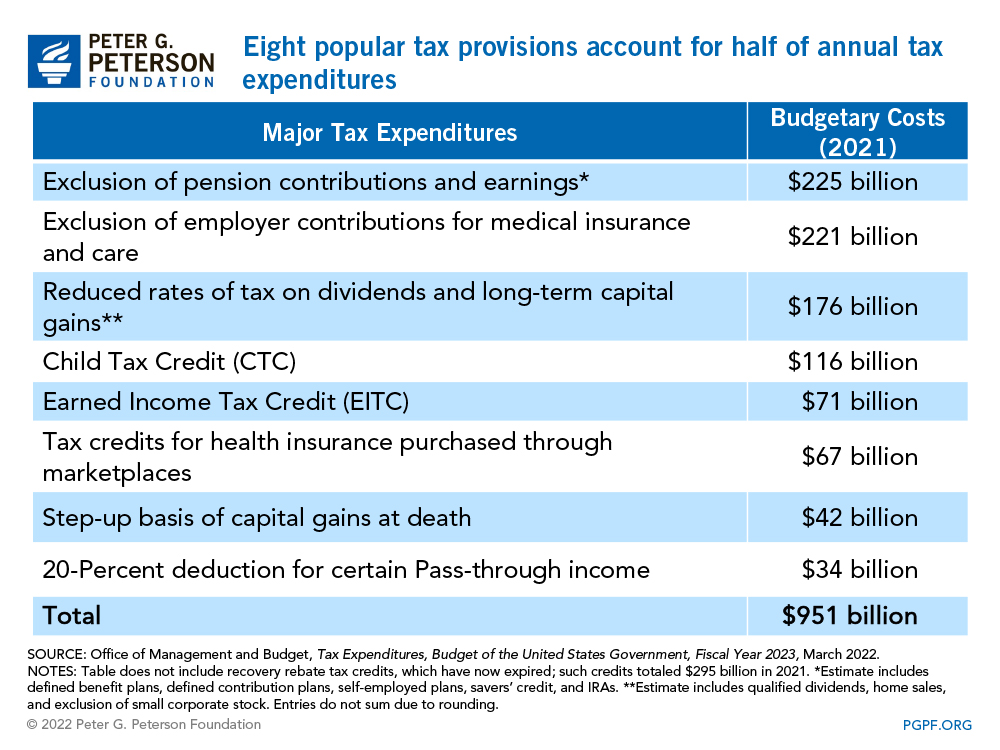

In 2010 tax and other noninterest income did not fully. May 26 2021. As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800.

Up to 85 percent of your benefits if your income is more than 34000 individual or 44000 couple. Social Security recipients will also receive a slightly higher benefit payment in 2021. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax.

Social Security functions much like a flat tax. In 2018 the cap is 128400. Youll be taxed on.

The largest social security tax increase was in 2021 but 2022 is high as well. 62 of each employees first 142800 of wages salaries etc. Half this tax is paid by the employee through payroll.

Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employees share of Social Security taxes of certain employees. However if youre married and file separately youll likely have to pay taxes on your Social Security income. Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers.

Social Security taxes in 2022 are 62 percent of gross wages up to 147000. The maximum amount of Social Security tax an employee will pay in 2021 is 885360. Time To Finish Up Your Taxes.

The 2022 limit for joint filers is 32000. In 2022 the Social Security tax rate is 62 for the employer and 62 for the employee. Import Your Tax Forms And File For Your Max Refund Today.

If you earned more than the maximum in any year whether in one job or more than one we only use the maximum to calculate your benefits. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Married filing jointly with 32000 to 44000 income.

Married filing separately and lived apart from their spouse for all of 2020 with 25000 to 34000 income. The self-employment tax rate is 153. The maximum earnings that are taxed have changed over the years as shown in the chart below.

This is the largest increase in a decade and could mean a higher tax bill for some high earners. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020. The maximum taxable amount for the Social Security tax is 142800 in 2021.

The Social Security tax limit is 147000 for 2022 up from 142800 in 2021. As of 2021 that amount increased to. The 2022 COLA of 59 percent increased the average retirement benefit by 92 a month.

More than 44000 up to 85 percent of your benefits may be taxable. The contributions are matched by their employers. How to Calculate Your Social Security Income Taxes.

This amount is also commonly referred to as the taxable maximum. Instructions for Form 8959 and Questions and Answers for the Additional Medicare Tax. Social Security taxes are assessed on all wages earned up to a capped maximum.

The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each. Exceed 142800 the amount in excess of 142800 is not subject to the Social. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

For earnings in 2022 this base is 147000. In 2021 payments grew by an average of 20 a month on the back of a 13 percent adjustment. Thus an individual with wages equal to or larger than 147000.

Up to 50 percent of your benefits if your income is 25000 to 34000 for an individual or 32000 to 44000 for a married couple filing jointly. Therefore the maximum amount that can be withheld from an employees paycheck in 2022 is 9114 62 percent of. If an employees 2021 wages salaries etc.

Fifty percent of a taxpayers benefits may be taxable if they are. What is the current cap on Social Security tax. Thus the most an individual employee can pay this year is 9114 Most workers pay their share through FICA Federal Insurance Contributions Act taxes withheld from their paychecks.

Maximum earnings subject to Social Security taxes 2021 in dollars Program Amount. The rate consists of two parts. Are married and file a separate tax return you probably will pay taxes on your benefits.

Its Estimated About 56 of Social Security Recipients Owe Income Taxes on Benefits. The portion of your benefits subject to taxation varies with income level. As a result the Trustees project that the ratio of 27 workers paying Social Security taxes to each person collecting benefits in 2020 will fall to 22 to 1 in 2039.

If your Social Security income is taxable the amount you pay will depend on your total combined retirement income. Ad The Portion of Your Benefits Subject to Taxation Varies With Income Level.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

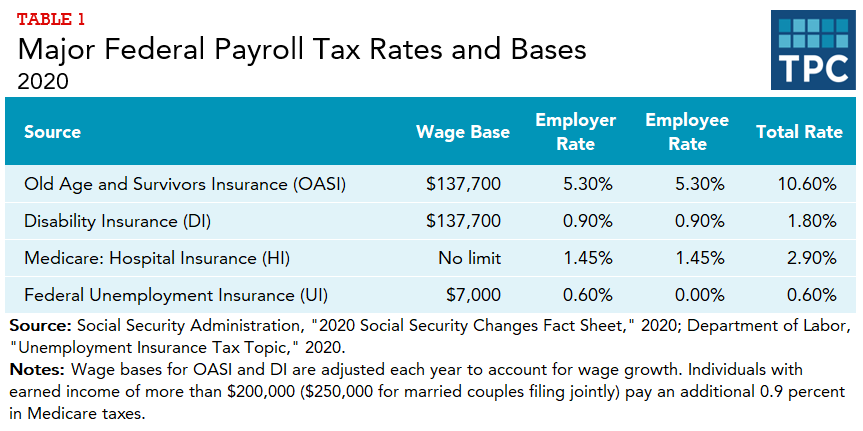

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

:max_bytes(150000):strip_icc()/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

How Do Marginal Income Tax Rates Work And What If We Increased Them

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Social Security Wage Base Increases To 142 800 For 2021

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Government Revenue Taxes Are The Price We Pay For Government

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)

/heroexportjourney-4229705-df42b41ba8f7483fba08a542a4eae4ac.jpg)